There is a lot to unpack in the Federal Government’s $130-billion welfare stimulus package.

Among the changes to welfare payments is a $1,500 fortnightly “JobKeeper” allowance for six million Australians. This is a substantial policy – it covers 44 per cent of the workforce and roughly 30 per cent of the economy’s wage bill over the short term. There is also a change to the “JobSeeker” payment – the income threshold for partners of those eligible for unemployment benefits has been lifted from $48,000 to $80,000.

Specifics aside, what is most important is the underlying trend – means testing has been relaxed and welfare now extends to a huge portion of the middle class who were previously ineligible. The fact that it is a Liberal Government expanding the social safety to unprecedented levels, however, should not come as a surprise. Morrison is merely following a pattern laid out by Liberal leaders before him.

Why now and why aimed at the middle-class?

There are many motivations and justifications for the expansion of the Australian welfare state. Economists have stressed that the wage stimulus will dampen short-term unemployment figures1 2. It is also hard to dispute the “fairness” argument: if the government mandated shutdown results in job losses, it can be argued that individuals should be compensated. However, Australia probably won’t know for some time if the government has got it right economically on either of these fronts, and that is beyond the scope of this article.

Past Liberal Party stalwarts Robert Menzies, and later John Howard, both broadened the welfare state against the political norm. Menzies founded the Liberal Party in the 1940s on policies which involved expanding the “social safety net” and abolishing Labor’s means tested unemployment benefits. Howard reaffirmed the Party’s commitment to Menzies-esque, middle-class welfare following his victory in 1996.

There is a strong public choice argument, which explains why Morrison, and many leaders before him, find increasing middle-class welfare so politically appealing. Politicians who support broad social-safety nets are not necessarily disingenuous, but if their objective is to support vulnerable Australians through economic hardship, then reducing means testing actually makes low-income households relatively worse off. An example of another policy which redistributes up the income ladder are generous solar feed-in tariffs.

The JobKeeper and JobSeeker payments mean low-income workers, like single parents and disabled employees, are taxed to pay for benefits which accrue to a large portion of the middle-class. In fact, a lot of the middle-class households, namely those with two or three incomes, such as university students or working mothers, may even be among the one million casual workers who are set to receive a taxpayer-subsidised payrise under the JobKeeper package.

To explain why the middle-class benefit most, let’s call all those covered under the pre-COVID-19 welfare reforms the “lower class”. All of those who are now covered under the government’s new wage subsidy, who previously were not, are the “middle class”. We can then consider the “upper class” as workers uncovered by both old and new welfare schemes.

To explain the impact requires some basic economic theory and diagrams.

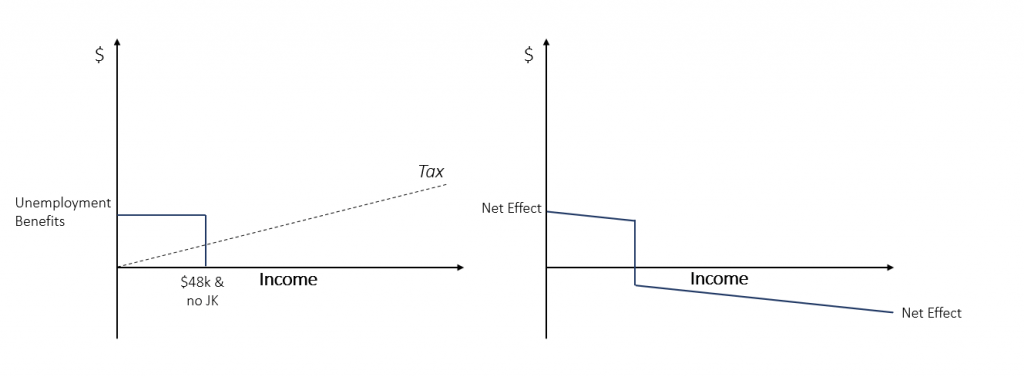

In the below diagrams, vertical axes represent a simple dollar measure. Income is shown on horizontal axes, with people arranged left to right according to the wealth categories described above. Figure 1 represents the pre-COVID-19 welfare system in Australia. Here, welfare payments are available only to low-income earners, and the unemployed with a partner earning less than $48,000. JobKeeper allowances do not exist. All low-income earners receive the available support. This drops to zero once a certain level of income is reached [1]. These transfer payments are paid for by taxes, which are levied on all of society and rise with income [2].

The right-side diagram shows how this impacts all Australians. Unemployed and low-income workers receive income support but also pay taxes – which increase as they earn more. When a person or household passes a threshold, they receive no more government support but continue to pay taxes. Thus, those who are well-off enough to fail the means test incur a net loss, which increases with income, indicated by the line slanting downward below zero.

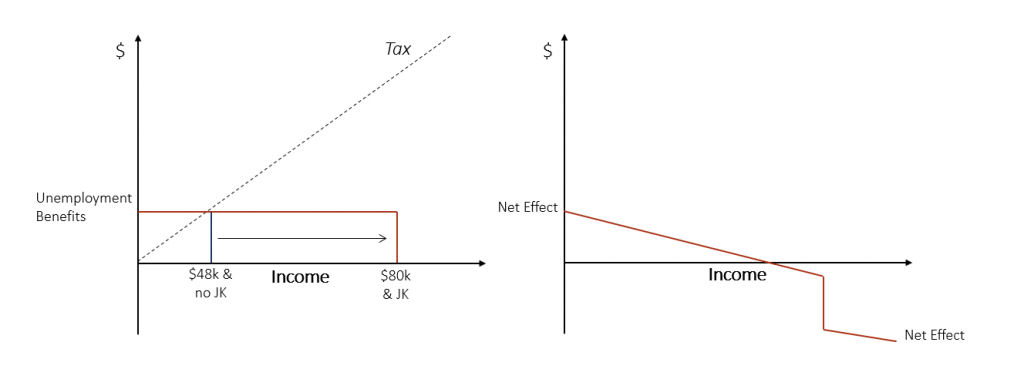

In Figure 2, Morrisons’ decision to increase the partner earning threshold for unemployment benefits to $80,000, as well as the government’s $1,500 subsidies, has extended the wage subsidy line to the right. Many middle-class Australians are now covered by unemployment benefits. To pay for this, the taxes levied on all individuals increase so the dashed tax line pivots upwards.

Once again, the right diagram shows the net effect of the COVID-19 response. Low-income earners receive the same income support as before [3], but pay higher taxes. The 6-million-plus people who had previously not received government support but now receive JobKeeper and JobSeeker also pay higher taxes. For most of them this is a good bargain, but for some the increase in taxes is more the than financial gain of the welfare reforms. In any event, the very wealthy will not receive the wage subsidy. From their standpoint the only effect is the increase in taxes.

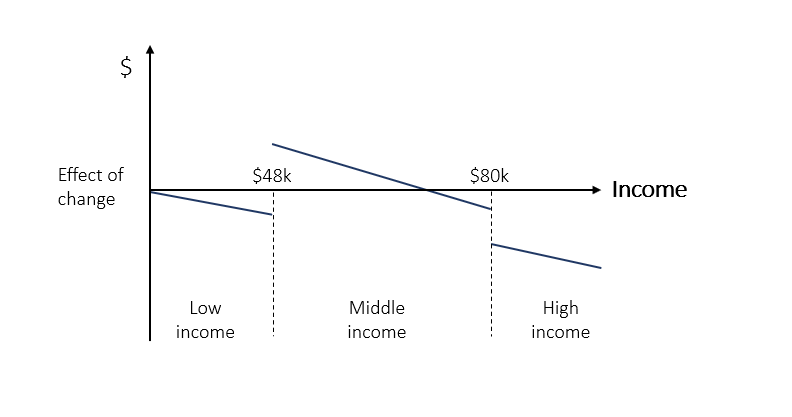

Figure 3 shows the difference between the effects on segments of the population. Expansion of social welfare has hurt low- and high-income earners. They receive the same benefits as before but pay higher taxes, though the program does benefit a large portion of the middle class. The reason for this is simple. Members of middle-income households now receive unemployment benefits, and, for most of them, although their taxes have gone up, the tax increase is less than the value of the subsidy.

Herein lies the problem with expanding welfare under the COVID-19 pandemic. There is a large group of people (44 percent of the workforce, to be precise) who have perfectly sound, self-interested reasons for wanting welfare to extend to the middle class. This is not to say that university students want to consciously harm single parents or the disabled, and indeed, they probably want to help them, but it is very easy to think that a program that helps you, helps those worse-off than you as well.

At present, governments, endowed with limited information, are making policy decisions which will impact taxpayers for generations to come. Is Morrison’s unprecedented economic stimulus the answer to the extraordinary policy landscape Australia finds itself in?

If the goal is to protect the most vulnerable Australians, then no. The scale of this stimulus package is unprecedented, but the policy response is unoriginal. The Liberal Party have favoured broadening social safety nets in the past, and when it increases their voter base, can you blame them?

[1] This assumption is not true of the Australian welfare system. As a general rule, instead of dropping off suddenly at a given point, welfare declines as income rises. Accounting for this in a diagram makes the figure overly complex but does not change the principle or outcome.

[2] Again, for simplicity of illustration, a straight line is used to indicate this relationship, but there is nothing in the reasoning that follows which requires a straight line (providing only that tax continues to rise in-line with income).

[3] The low-income workers on welfare pre-COVID-19 receive some additional benefits as a result of the changes to the “JobSeeker” program, but the program now covers more Australians, and JobSeeker payments are marginally less than the “JobKeeper” wage subsidies. Again, this is not illustrated for simplicity, but it does not change the principle or outcome.